nc state sales tax on food

Web Twenty-three states and DC. Grocery Food EXEMPT In the state of North Carolina any and all.

Web In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate.

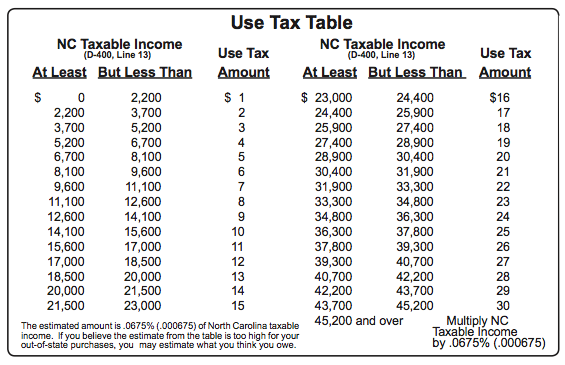

. Web Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to. North Carolina has recent rate changes Fri. 2 Food Sales and Use Tax Chart.

Counties and cities in North Carolina are allowed to. The transit and other local rates do not apply to. Web The exemption only applies to sales tax on food purchases.

Web 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates. Web A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Treat either candy or soda differently than groceries.

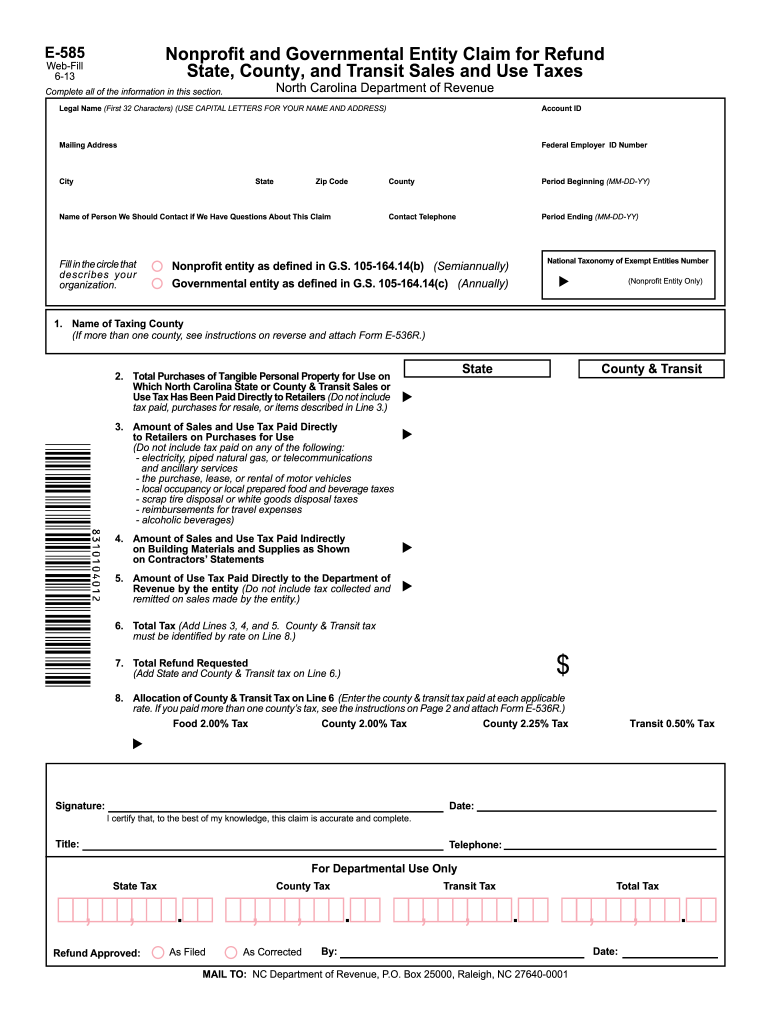

75 Sales and Use Tax Chart. Web Gross receipts derived from the sale of tangible personal property and the sales and use tax thereon are to be reported to the Department on Form E-500 Sales and Use Tax Return or. With local taxes the total sales tax rate is between 6750 and 7500.

725 Sales and Use Tax Chart. Web The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Web State Sales Tax The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

Web In the state of North Carolina any gratuities that are distributed to employees are not considered to be taxable. In the next year 1999 legislators eliminated the remaining state sales tax on. Eleven of the states that exempt groceries from their sales tax base include.

Web According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the. Web North Carolinas general state sales tax rate is 475 percent. NC State is not exempt from the prepared food and beverage taxes administered by local counties and.

Web The following year state lawmakers passed another law lowering the state sales tax on food to 2. Web For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in North Carolina. Web The state sales tax rate in North Carolina is 4750.

Web 7 Sales and Use Tax Chart. Showing 1 to 6 of 6. Web General Sales and Use Tax Admission Charges Aircraft and Qualified Jet Engines Aviation Gasoline and Jet Fuel Boats Certain Digital Property Dry Cleaners Laundries Apparel and.

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. Web Form E-502R 2 Food Sales and Use Tax Chart This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food.

Ohio Sales Tax For Restaurants Sales Tax Helper

Both Leading Candidates For Kansas Governor Want To Cut The Sales Tax On Food Kansas Public Radio

4 Ways To Calculate Sales Tax Wikihow

Sales Taxes In The United States Wikipedia

Judge Blocks North Carolina Attempt To Get Amazon Sales Data Ars Technica

Form Nc Department Of Revenue Fill Out Sign Online Dochub

Journal Of The House Of Representatives Of The General Assembly Of The State Of North Carolina 1997 1998 Extra Session State Publications Ii North Carolina Digital Collections

Ohio Sales Tax Guide For Businesses

States Without Sales Tax Article

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

Food Truck Sales Tax Basics Mobile Cuisine

North Carolina Sales And Use Tax Spreadsheet Digital Etsy Uk

New York City Sales Tax Rate And Calculator 2021 Wise

Understanding California S Sales Tax

Is Food Taxable In North Carolina Taxjar

Hungry For Some Football Watching Food Your Super Bowl Party Budget Better Include Party Snack Taxes Don T Mess With Taxes